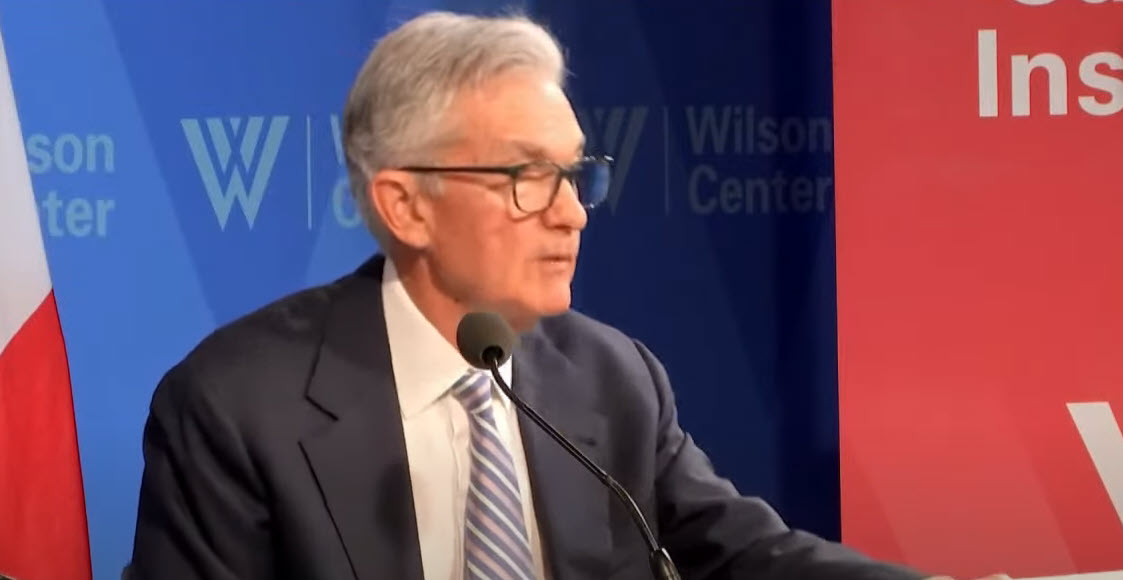

As the Federal Reserve’s June policy meeting minutes are set to be released today at 2 p.m. Eastern Time, Americans eagerly await insights into the central bank’s outlook on interest rates. Following recent indications from Fed Chair Jerome Powell, experts predict that higher credit card interest rates and increased costs for home and car financing may be on the horizon. This article examines the implications of potential interest rate hikes on consumer borrowing costs, drawing on current and relevant sources.

The Federal Reserve’s Stance:

During the June policy meeting, the Federal Reserve discussed the need for measures to curb inflationary pressures. Chair Jerome Powell conveyed that the possibility of another half-percentage point increase in interest rates this year remains a viable option. The meeting minutes, to be released today, will provide a detailed account of the discussions and deliberations that occurred.

Impact on Credit Card Interest Rates:

Higher interest rates are likely to have a direct impact on credit card holders. As the Federal Reserve raises rates to manage inflation, credit card companies tend to adjust their rates accordingly. This could lead to increased interest charges for outstanding balances, potentially affecting millions of Americans who rely on credit cards for everyday purchases and expenses.

Financial institutions determine credit card interest rates based on the prime rate, which is influenced by the Federal Reserve’s benchmark interest rate. When the Fed raises rates, banks may pass on the increased costs to consumers. As a result, individuals with credit card debt may experience higher monthly interest payments, making it more challenging to pay down their balances.

Effect on Home and Car Financing:

Prospective homeowners and car buyers should also pay attention to the potential impact of rate hikes. When the Federal Reserve raises interest rates, mortgage rates and auto loan rates typically follow suit. As borrowing costs increase, individuals seeking financing for their homes or vehicles may encounter higher interest rates, resulting in larger monthly payments or reduced affordability.

Rising mortgage rates could impact both potential buyers and existing homeowners. For those looking to enter the housing market, higher rates might reduce their purchasing power or force them to opt for smaller loan amounts. Homeowners with adjustable-rate mortgages or considering refinancing may face higher interest charges, influencing their financial decisions.

Likewise, car buyers may find that loan rates become less favorable as interest rates rise. This could increase the cost of purchasing a vehicle or lead to longer loan terms to manage monthly payments, potentially impacting affordability for many consumers.

Considerations for Consumers:

Given the potential impact of future rate hikes, consumers should evaluate their financial situation and take proactive steps to mitigate any adverse effects. Here are some considerations:

Debt management: Those with credit card debt should consider developing a plan to pay down balances more aggressively, especially if interest rates rise. Exploring balance transfer options or seeking lower-rate credit cards may also be prudent.

Housing decisions: Prospective homebuyers and homeowners with adjustable-rate mortgages should assess the potential impact of rising interest rates on their budgets. Consulting with mortgage lenders or financial advisors can provide valuable insights into the feasibility of their plans.

Car financing: Car buyers should evaluate their budgets and assess the affordability of potential loan payments under higher interest rates. Researching and comparing loan offers from different lenders can help secure the best available rates.

Conclusion:

As the Federal Reserve’s June meeting minutes are released today, Americans await valuable insights into the central bank’s outlook on interest rates. With indications of potential rate hikes, consumers should prepare for the possibility of increased credit card interest rates and higher borrowing costs for home and car financing. By staying informed and taking proactive measures, individuals can navigate these changes and make well-informed financial decisions.