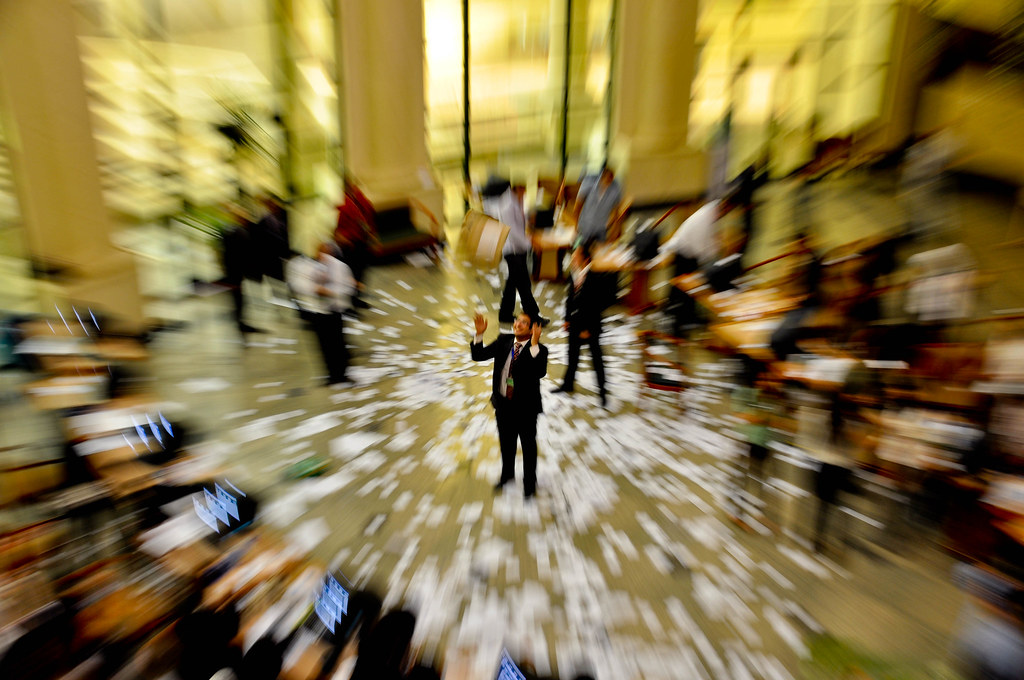

While Wall Street erupts in celebration, a chorus of caution resonates from the halls of the Federal Reserve. Despite financial markets joyously anticipating potential interest rate cuts next year, Fed officials urge a dose of realism amidst the exuberance.

Fed Chair Jerome Powell, in a recent news conference, threw a dampener on unbridled optimism. His measured statement, “we are likely at or near the peak rate for this cycle,” hinted at a pause in the aggressive rate hikes, but not a definitive pivot towards easing.

The Fed’s decision to hold rates steady for the third consecutive meeting last week signaled a potential shift in its tightening campaign. This, coupled with Powell’s cautious optimism, fueled speculation about early rate cuts in 2024. However, Fed officials are quick to temper such enthusiasm.

John Williams, President of the New York Fed, emphasized the need for continued vigilance against inflation. “The job is not done,” he remarked, highlighting the persistence of inflationary pressures despite recent declines. Other officials echoed similar sentiments, stressing the importance of data-driven decisions and a gradual approach to monetary policy normalization.

Their concerns are warranted. While inflation has shown signs of easing, it remains well above the Fed’s 2% target. Additionally, geopolitical uncertainties, ongoing supply chain disruptions, and labor market tightness pose potential risks to the disinflationary trajectory.

The market’s current exuberance is understandable. A pause in rate hikes, even without cuts, would provide much-needed relief to borrowers and boost asset prices. However, a premature celebration could be perilous. As Fed officials repeatedly warn, the central bank remains committed to its inflation-fighting mandate, and the path to lower rates remains contingent on sustained progress on the inflation front.

The coming months will be crucial. Economic data releases, Fed pronouncements, and market reactions will all paint a clearer picture of the future monetary policy landscape. Investors would be wise to heed the Fed’s cautious optimism and prepare for a potentially prolonged period of policy uncertainty.

While the possibility of rate cuts in 2024 cannot be entirely dismissed, celebrating them preemptively is a risky proposition. The Fed’s message is clear: inflation remains the dominant concern, and any monetary policy decisions will be driven by data, not market euphoria. Investors and policymakers alike would be wise to navigate the current economic landscape with measured steps and a keen eye on the evolving data landscape. Only then can the cheers on Wall Street translate into sustainable economic growth and stability.