The recent surge in oil prices is causing a ripple effect at the gas pump, with consumers feeling the pinch as fuel costs climb. In Washington, DC, rising oil costs are not only impacting consumers but also influencing the nation’s emergency oil reserves, leading to significant decisions from the Biden administration.

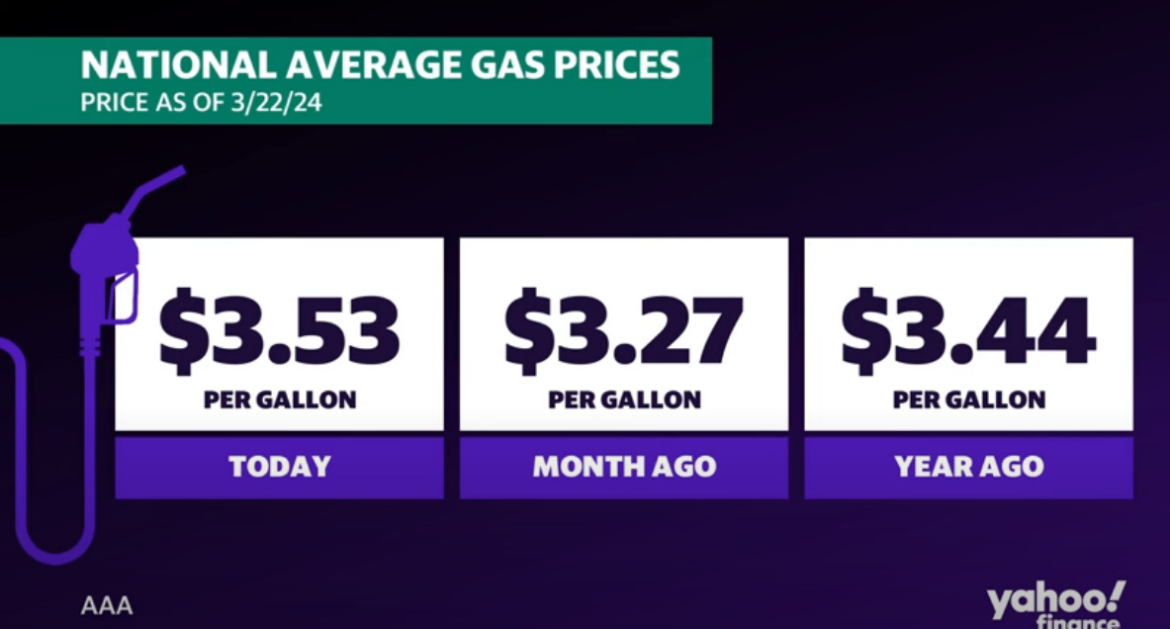

U.S. crude oil prices soared to $85 per barrel this week, driven by escalating tensions in the Middle East and the ongoing conflict in Ukraine. This surge has translated into an average increase of 20 cents per gallon of gasoline over the past month, bringing the national average to $3.55 per gallon. Analysts, including those at Goldman Sachs, are projecting further hikes, with estimates suggesting gas prices could hit $4 per gallon by May if current trends persist.

The Biden administration, in response to these developments, has made the decision to halt purchases of oil for refilling the nation’s emergency reserves. This move comes as a response to the exorbitant costs associated with acquiring oil amid the ongoing price surge. Notably, the administration had previously withdrawn approximately 260 million barrels of oil from the reserve during 2021 and 2022, underscoring the significance of these emergency reserves during periods of supply disruption or price volatility.

The decision to pause oil purchases for the emergency reserves reflects a delicate balancing act for the Biden administration. While emergency reserves are crucial for ensuring energy security and stability, the current high costs of oil procurement necessitate a strategic approach to managing these reserves effectively.

The impact of rising oil prices extends beyond the pump, affecting various sectors of the economy, including transportation, logistics, and consumer spending. As fuel costs continue to rise, consumers are likely to adjust their spending habits, potentially impacting economic growth and inflationary pressures.

The situation underscores the complex interplay between global geopolitical events, energy markets, and domestic policy decisions. As oil prices remain volatile, stakeholders across sectors are closely monitoring developments and assessing strategies to mitigate the economic impacts of these fluctuations.