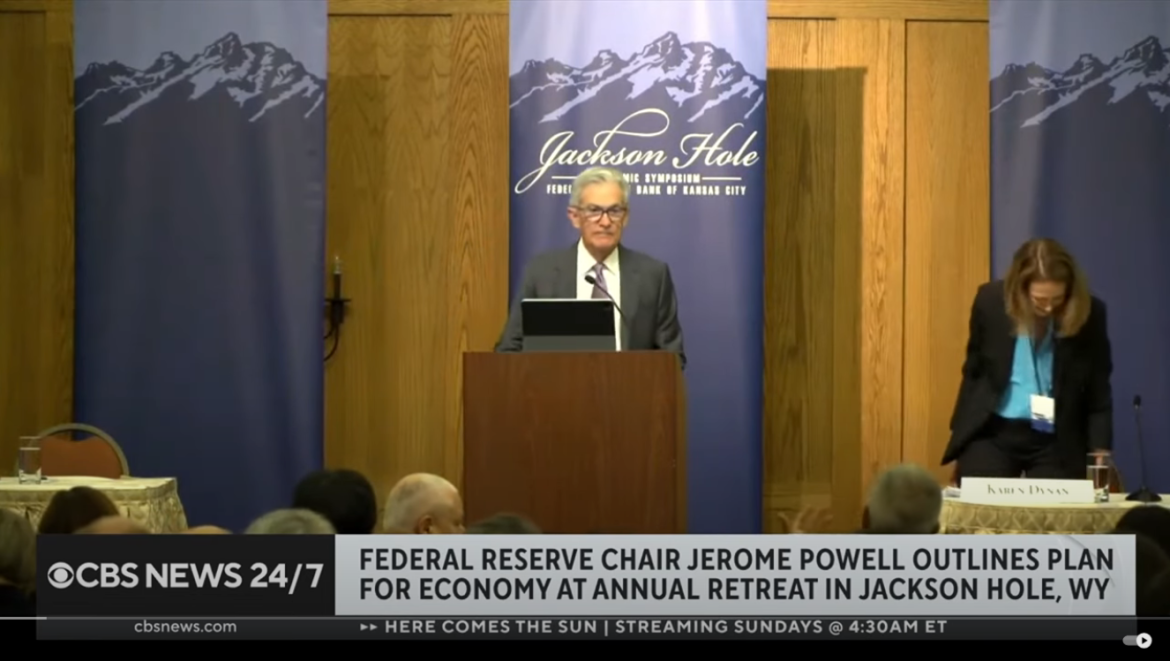

Federal Reserve Chair Jerome Powell has confirmed that the central bank is prepared to begin cutting interest rates, signaling a significant shift in U.S. monetary policy. Speaking at the Federal Reserve’s annual gathering in Jackson Hole, Wyoming, Powell emphasized that “the time has come for policy to adjust,” as the economy shows signs of progress on inflation.

Powell’s remarks mark a pivotal moment for the Federal Reserve, which has been grappling with high inflation and the challenges of managing economic growth. With inflationary pressures starting to ease, Powell indicated that the Fed’s focus will now turn to ensuring that the U.S. economy remains strong and resilient. “We have made considerable progress on inflation,” Powell stated, “and this gives us the opportunity to consider adjustments that will support continued economic growth.”

The decision to consider interest rate cuts comes after a prolonged period of rate hikes aimed at curbing inflation, which reached historic levels during the post-pandemic economic recovery. As inflation begins to stabilize, the Fed is carefully evaluating the timing and extent of any potential rate reductions.

Federal Reserve Bank of Chicago President Austan Goolsbee also weighed in on the matter, reinforcing Powell’s cautious approach. Following the release of the U.S. July jobs report, Goolsbee highlighted the importance of not overreacting to short-term economic data. “We’d never want to overreact to any one month’s numbers,” Goolsbee remarked, emphasizing that economic conditions and data will play a crucial role in determining the timing and size of any rate cuts.

Goolsbee further noted that policymakers will have access to a substantial amount of economic data before the Fed’s next meeting, which will guide their decisions. This approach underscores the Fed’s commitment to a data-driven policy that adapts to the evolving economic landscape.

The July jobs report showed continued growth in the U.S. labor market, though at a slower pace compared to previous months. This trend of gradual slowing aligns with the Fed’s objectives of cooling the economy to prevent overheating while avoiding a recession. The balancing act between sustaining economic growth and controlling inflation remains at the forefront of the Fed’s policy considerations.

Investors and market analysts are closely watching the Fed’s next moves, as interest rate cuts could have broad implications for the economy, including the housing market, consumer spending, and business investments. The potential for lower borrowing costs could provide a boost to economic activity, though it also carries the risk of reigniting inflation if not carefully managed.

Powell’s comments at Jackson Hole have set the stage for a period of careful deliberation and adjustment by the Federal Reserve. As the central bank navigates this complex economic environment, the focus will remain on maintaining stability and fostering conditions for sustainable growth.