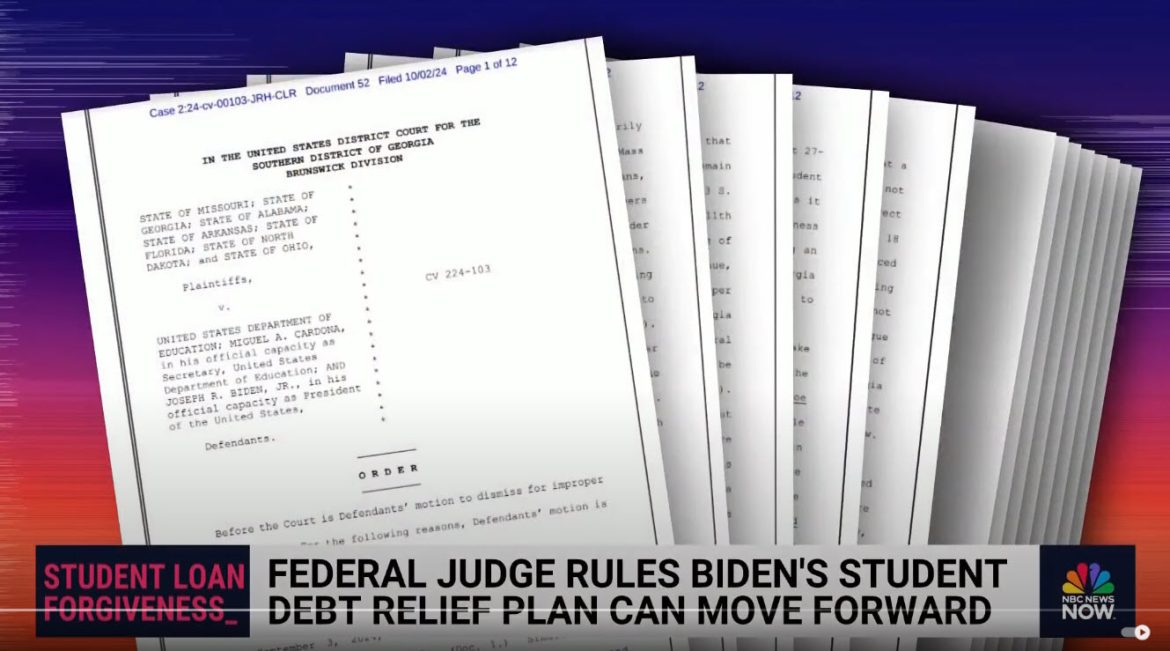

President Joe Biden’s student loan forgiveness program has taken a significant step forward after a federal judge allowed a temporary restraining order on the plan to expire. This decision clears the way for the Biden administration to proceed with its highly anticipated initiative, which promises to cancel billions of dollars in student loan debt for millions of borrowers. The ruling marks a key moment in a legal saga that has seen challenges from multiple states aimed at halting the program.

The decision came from a federal judge in Georgia, who declined to extend the restraining order that had temporarily blocked the plan. With this legal hurdle removed, the Biden administration can now begin implementing the relief program. However, the battle is far from over, as ongoing lawsuits filed by several Republican-led states, including Missouri and Georgia, continue to challenge the legality of the plan.

Biden’s Debt Relief Plan Back on Track

The Biden administration’s student loan forgiveness program aims to cancel up to $20,000 in student debt for borrowers who meet specific income criteria. The plan was introduced as part of Biden’s broader efforts to address the nation’s $1.7 trillion student loan crisis and ease the financial burden on millions of Americans. Under the program, individual borrowers earning less than $125,000 per year, or households earning under $250,000, are eligible for up to $10,000 in debt cancellation. Borrowers who received Pell Grants—aid for low-income students—can receive an additional $10,000 in forgiveness.

With the judge’s ruling allowing the plan to move forward, the White House has announced that it is preparing to implement the relief measures as soon as possible. “We are ready to start delivering relief to millions of hardworking Americans,” said White House Press Secretary Karine Jean-Pierre. “This ruling is a victory for borrowers across the country who have been waiting for this assistance.”

Legal Challenges Persist

Despite this victory for the Biden administration, the legal fight is far from over. A federal judge in St. Louis, appointed by former President Donald Trump, issued a ruling just a day earlier that blocked the plan from moving forward in the state of Missouri. This decision came after seven Republican-led states filed a lawsuit against the Biden administration, arguing that the debt forgiveness plan is illegal and exceeds the president’s executive authority. The states contend that such sweeping financial relief should require congressional approval.

In his ruling, the St. Louis judge reasoned that allowing the Biden administration to eliminate student loan debt before the courts had a chance to fully review the case could effectively strip the courts of their ability to assess the legality of the plan. This ruling has sent the case back to Missouri for further review.

States Challenge the Plan’s Legality

The states involved in the lawsuit—Arkansas, Iowa, Kansas, Missouri, Nebraska, South Carolina, and Georgia—argue that Biden’s plan unlawfully circumvents Congress, which has the sole authority to make such decisions on federal spending. Missouri in particular raised concerns that the forgiveness plan could harm the state’s finances by reducing the income generated by its student loan servicing agency.

However, legal experts are divided on whether the states have standing to block the plan, particularly since the majority of borrowers who stand to benefit from debt forgiveness are not residents of these states. Danny Cevallos, a legal analyst for NBC News, noted, “The states are arguing harm, but proving that harm in a court of law is a tall order. The real issue will be whether the courts find they even have the authority to weigh in on this type of executive action.”

Impact on Borrowers and What’s Next

For borrowers, the recent ruling in Georgia is a much-needed reprieve. Many have expressed frustration over the uncertainty surrounding the program, with payments set to resume soon after a pause during the COVID-19 pandemic. Advocacy groups have praised the judge’s decision and called on the Biden administration to move swiftly to deliver the promised relief.

“We’re thrilled to see the courts allow this program to move forward. It’s a lifeline for millions of Americans who are struggling to make ends meet,” said Natalia Abrams, president of the Student Debt Crisis Center. “The Biden administration must now ensure that this relief reaches borrowers as quickly as possible, even as these legal battles continue.”

The Biden administration has pledged to keep fighting for the plan in court and is optimistic about the legal path forward. Still, the ultimate fate of the student loan forgiveness plan remains uncertain as it faces further legal challenges, particularly in Missouri, where the next phase of the legal battle will play out.

Borrowers are advised to stay updated on the latest legal developments as the case continues, with the possibility of further court rulings impacting the timeline for relief.