Two Democratic lawmakers are accusing major corporations Coca-Cola, PepsiCo, and General Mills of engaging in “shrinkflation,” a practice where companies reduce product sizes while maintaining or raising prices. The accusation comes amid concerns that the companies are driving profits by shortchanging consumers, especially during a period of rising costs and inflation.

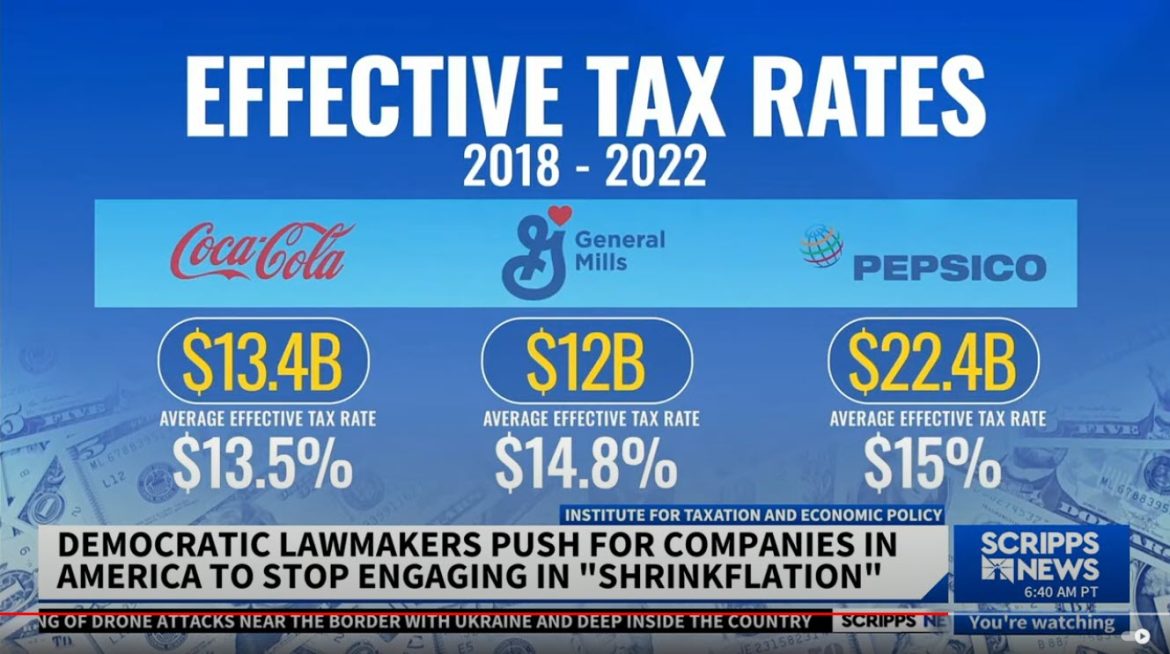

The lawmakers argue that while these corporations have reported billions in profits from 2018 to 2022, they are benefiting from favorable tax rates far below the corporate tax rate of 21%. According to their findings, Coca-Cola made $13.4 billion over the four-year period and paid an effective tax rate of just 13.5%. General Mills made $12 billion and paid an average tax rate of 14.8%, while PepsiCo earned $22.4 billion with an effective tax rate of 15%. All these rates are significantly lower than the current corporate tax rate, which was reduced from 35% to 21% under President Trump’s 2017 tax reforms.

“Shrinkflation is just another way for these corporations to boost their bottom line at the expense of consumers, all while they benefit from reduced tax rates that don’t align with the amount they should be paying,” one of the lawmakers said. They argue that everyday Americans are feeling the pinch of paying the same or more for less product, while the companies continue to report soaring profits and pay lower-than-expected taxes.

What Is Shrinkflation?

Shrinkflation refers to the practice where companies reduce the quantity of a product—such as the number of ounces in a soda bottle or cereal box—while keeping the price the same or even increasing it. It allows corporations to quietly pass on higher costs to consumers without raising prices outright, often without consumers realizing the change.

The lawmakers assert that shrinkflation has become more prevalent in recent years, especially during the pandemic and subsequent inflationary pressures, which saw raw material costs and supply chain disruptions. These tactics, they argue, disproportionately harm consumers who are already dealing with high inflation, while big corporations like Coca-Cola, General Mills, and PepsiCo see record profits.

Corporations Respond

All three companies have yet to respond directly to the lawmakers’ accusations of shrinkflation or the claims about their tax rates. However, companies often defend such pricing strategies by pointing to the rising costs of raw materials, transportation, and production as reasons for downsizing products without reducing prices.

The issue has drawn national attention as consumers increasingly notice shrinking package sizes at grocery stores, a trend experts say could continue as inflationary pressures remain high.

Political and Economic Implications

The accusations come as part of a broader effort by Democratic lawmakers to scrutinize corporate behavior and the growing gap between corporate profits and consumer well-being. Lawmakers are calling for increased corporate accountability and for companies to pay their fair share in taxes, particularly as middle- and working-class Americans continue to grapple with high costs of living.

The discussion also brings into focus the impact of the 2017 tax cuts, which critics argue primarily benefited large corporations and wealthy individuals, while not delivering the promised economic benefits for ordinary Americans.

As inflation continues to dominate headlines, the issue of shrinkflation is expected to remain in the spotlight, with more consumers and policymakers scrutinizing corporate practices that affect household budgets.