In November 2024, President-elect Donald Trump appointed Elon Musk and biotech entrepreneur Vivek Ramaswamy to lead the newly established Department of Government Efficiency (DOGE), tasked with streamlining federal operations and reducing government expenditures. Shortly after his appointment, Musk publicly called for the elimination of the Consumer Financial Protection Bureau (CFPB), stating on X (formerly Twitter), “Delete CFPB. There are too many duplicative regulatory agencies.”

The CFPB was created in 2010 under the Dodd-Frank Act, following the 2008 financial crisis, to oversee consumer financial products and protect consumers from unfair practices. Since its inception, the agency has been a focal point of conservative criticism, with opponents arguing that it wields excessive power and operates with insufficient accountability. Republicans have long sought to curtail the CFPB’s authority, viewing it as an impediment to free enterprise.

Musk’s call for the CFPB’s abolition aligns with these conservative perspectives. His DOGE co-lead, Vivek Ramaswamy, echoed this sentiment, asserting that the CFPB, established less than two decades ago, has not improved consumer welfare and has, in fact, been detrimental.

The CFPB has been instrumental in enforcing consumer protection laws, achieving significant outcomes such as ordering Wells Fargo to pay $3.7 billion in 2022 for illegal fees and interest charges, and banning Navient from federal student loan servicing in 2023, accompanied by a $100 million restitution to affected borrowers. Overall, the agency’s enforcement actions have resulted in nearly $20 billion in consumer relief and $5 billion in fines.

Despite these accomplishments, the CFPB’s funding mechanism has been a point of contention. Unlike many federal agencies, the CFPB is funded through the Federal Reserve rather than the congressional appropriations process. This structure was challenged but upheld by the Supreme Court in May 2024, with a 7-2 ruling affirming its constitutionality.

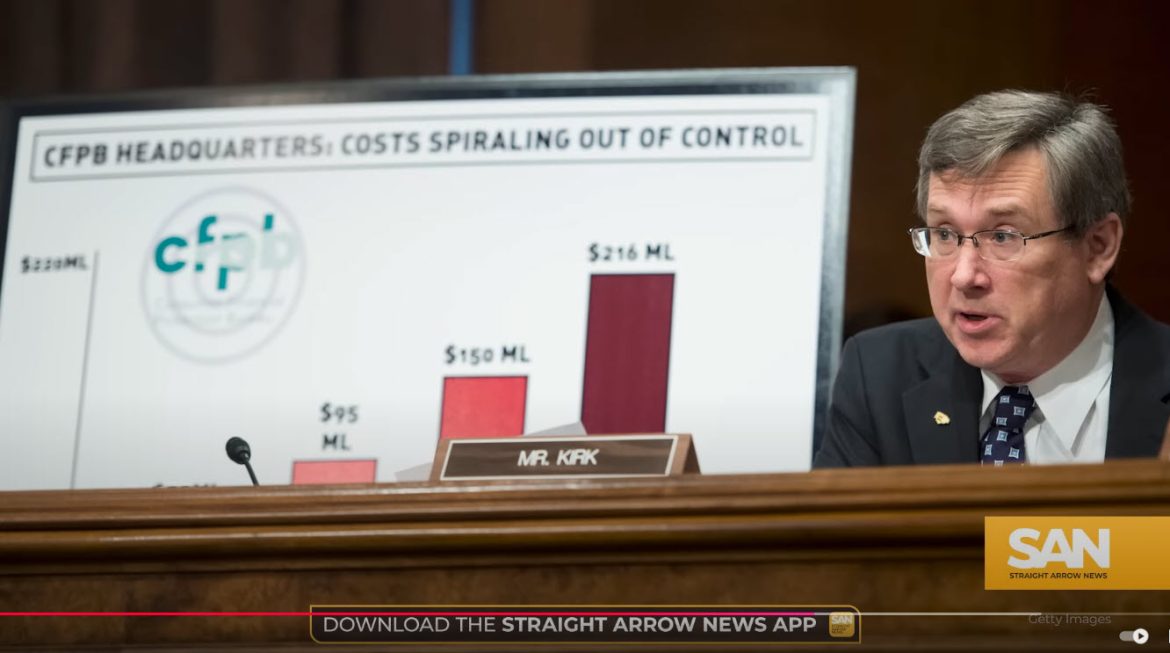

As the incoming administration prepares to assume office, the future of the CFPB remains uncertain. While dismantling the agency would require congressional action—a challenging endeavor given the legislative process—the Trump administration may pursue strategies to limit its influence, such as appointing leadership aligned with its deregulatory agenda or reducing its budget.

Proponents of the CFPB argue that its role is crucial in safeguarding consumers from financial misconduct and that its dissolution could leave individuals vulnerable to predatory practices. Conversely, critics contend that the agency imposes burdensome regulations that stifle economic growth and that its functions could be absorbed by existing entities to enhance efficiency.

The debate over the CFPB’s future encapsulates broader discussions about the balance between consumer protection and regulatory oversight, highlighting the complexities inherent in reforming federal agencies.