As the Federal Open Market Committee (FOMC) convenes its first meeting of 2025, Federal Reserve officials are grappling with significant fiscal policy uncertainties stemming from the Trump administration’s proposed economic measures. These uncertainties are influencing the Fed’s deliberations on monetary policy, particularly regarding interest rate adjustments.

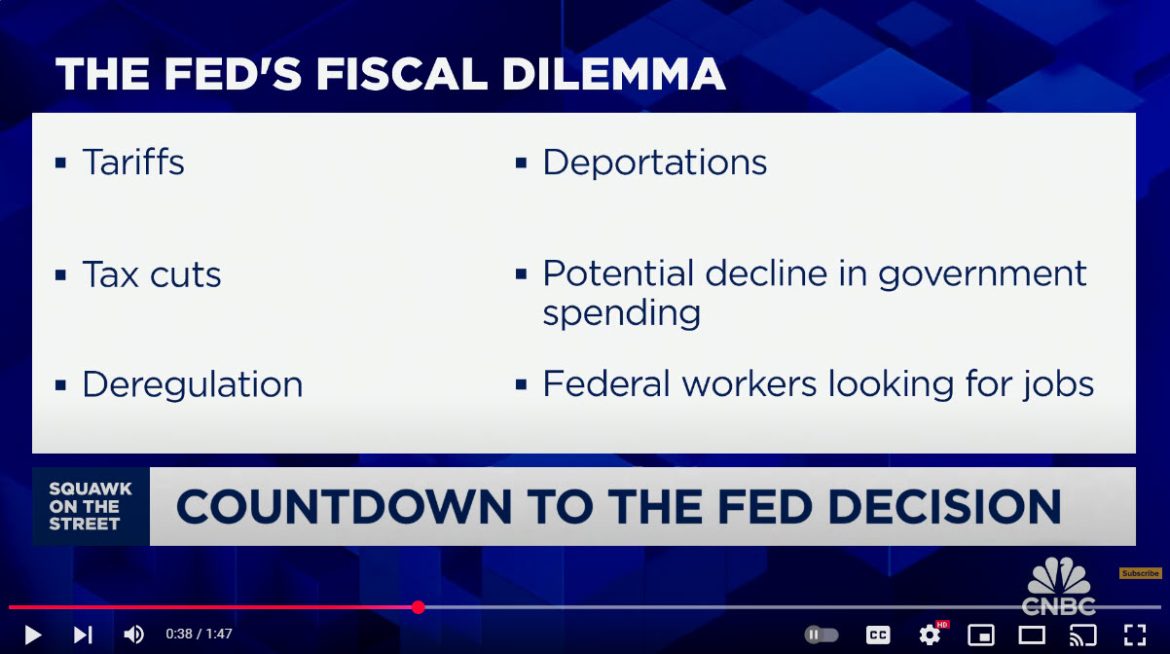

President Donald Trump has been vocal in advocating for substantial interest rate cuts, asserting that such reductions are essential to bolster economic growth. He has emphasized his understanding of interest rates and has expressed a desire for significant cuts. However, the Fed, under the leadership of Chair Jerome Powell, is expected to maintain the current benchmark rate of 4.25-4.5 percent following three consecutive cuts. This cautious stance reflects concerns about potential inflationary pressures and the broader economic impact of the administration’s aggressive fiscal policies, including proposed tariffs and tax cuts.

The Fed’s dual mandate—to achieve maximum employment and maintain price stability—guides its policy decisions. Recent economic indicators present a mixed picture: while the labor market remains robust, with stable employment figures, inflation rates have shown only modest progress toward the Fed’s 2% target. In November, the annual inflation rate was reported at 2.4%, slightly above the desired level. These factors contribute to the Fed’s inclination to hold interest rates steady in the near term.

The composition of the FOMC has also shifted, with the introduction of new voting members who bring diverse perspectives on monetary policy. Austan Goolsbee, known for his dovish stance, advocates for a more accommodative policy, while Alberto Musalem and Jeffrey Schmid are recognized for their stricter views on inflation control. This diversity could lead to more dynamic discussions and potential disagreements within the committee, especially in light of the current fiscal uncertainties.

Investors are closely monitoring these developments, seeking clarity on the Fed’s policy trajectory. The uncertainty surrounding the administration’s fiscal policies, particularly regarding tariffs and their potential to exacerbate inflation, has led many bond investors to adopt defensive strategies. There is a prevailing expectation that the Fed will maintain its current interest rate stance, with Chair Powell likely signaling a cautious approach in response to the evolving economic landscape.

As the FOMC meeting progresses, the interplay between the administration’s fiscal initiatives and the Fed’s monetary policy decisions remains a focal point. The outcomes of these discussions will have significant implications for the U.S. economy, influencing growth trajectories, inflation rates, and the broader financial landscape.