Wall Street is reeling as the Dow Jones Industrial Average plummets more than 1,000 points in a sharp sell-off, driven by President Donald Trump’s escalating attacks on Federal Reserve Chair Jerome Powell and persistent fears over his aggressive tariff policies. The S&P 500 and Nasdaq Composite are also down significantly, each shedding over 2% as investors grapple with uncertainty surrounding U.S. monetary policy and the intensifying U.S.-China trade war.

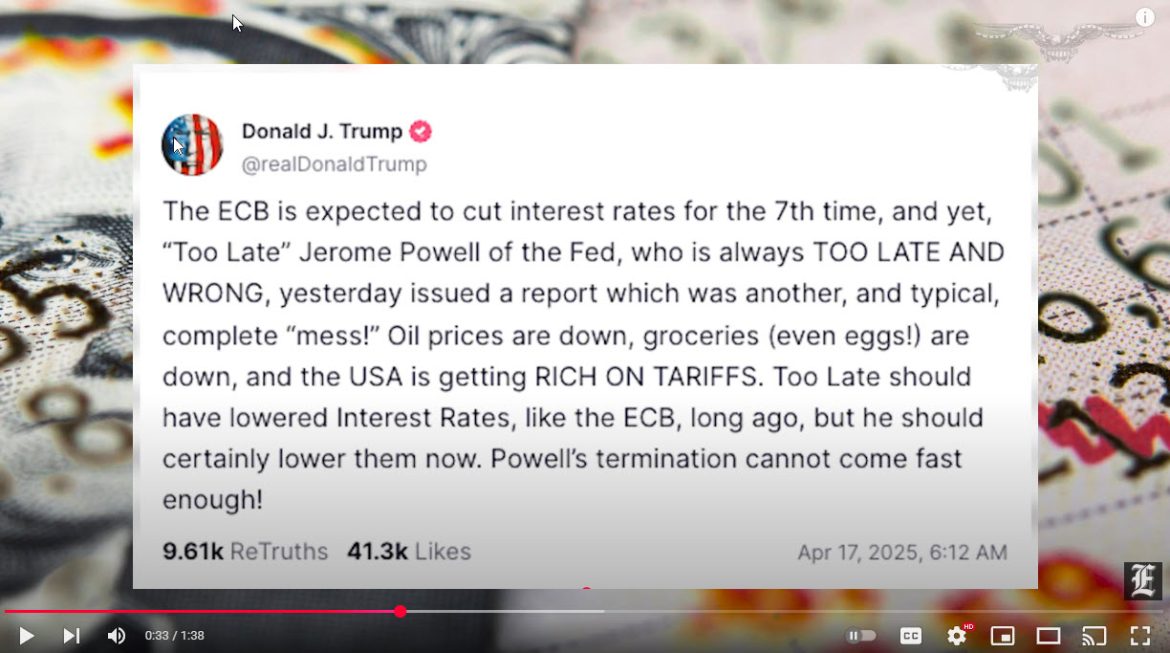

The market’s turmoil began early today when the Dow fell 700 points in midmorning trading, a decline that accelerated to 900 points and then surpassed 1,000 points by midday. Trump’s latest salvo came via a Truth Social post, where he labeled Powell “Mr. Too Late, a major loser” and demanded an immediate interest rate cut to counteract the economic fallout from his trade policies. The president’s criticism has raised alarms about the Federal Reserve’s independence, a cornerstone of U.S. economic stability, further eroding investor confidence.

Tariff concerns are compounding the market’s woes. Since taking office in January 2025, Trump has implemented a series of sweeping tariffs, including a 10% baseline tariff on all U.S. trading partners and a dramatic escalation of levies on Chinese goods, now reaching an effective rate of 145% following a correction from an earlier announced 125%. China retaliated with 34% tariffs on U.S. goods, effective April 10, 2025, intensifying a tit-for-tat trade war that has rattled global markets. The Nasdaq Composite, heavily weighted with tech stocks reliant on Chinese manufacturing, has entered bear market territory, down over 20% from its December 2024 high.

The S&P 500 has lost 16% from its February 2025 peak, while the Dow is in correction territory, down 14% from its record high. Major sectors, including technology, consumer discretionary, and industrials, are bearing the brunt of the sell-off. Shares of Tesla have dropped 6.9%, Nvidia 5%, and Caterpillar 3%, reflecting broad-based concerns about higher production costs and reduced global demand due to tariffs. The Cboe Volatility Index (VIX), often called Wall Street’s “fear gauge,” has surged 50%, signaling extreme market anxiety.

Federal Reserve Chair Jerome Powell has warned that Trump’s tariffs are “larger than expected” and likely to fuel higher inflation and slower economic growth. Speaking at a business journalists’ conference in Arlington, Virginia, on April 4, 2025, Powell noted that the tariffs could undermine the Fed’s dual mandate of 2% inflation and maximum employment. Despite Trump’s calls for rate cuts, Powell has emphasized a cautious, data-dependent approach, stating that the economic outlook remains “highly uncertain.” This stance has frustrated investors hoping for immediate Fed intervention to stabilize markets.

The roots of today’s market unrest trace back to early 2025, when Trump announced his “Liberation Day” tariffs on April 2, imposing a minimum 10% tax on nearly all imports and higher levies on countries like China, Japan, and the European Union. The Dow plunged 1,679 points on April 3, followed by a 2,231-point drop on April 4, marking the worst two-day loss since the COVID-19 crisis in 2020. A brief rally occurred on April 9, when Trump paused some tariffs for 90 days, prompting the Dow to soar 2,962 points. However, the reprieve was short-lived, as renewed tariff escalations and retaliatory measures from China reignited market fears.

Analysts are sounding alarms about the broader economic implications. Economists warn that tariffs, which act as taxes on imported goods, are likely to raise consumer prices for electronics, clothing, cars, and food, potentially curbing spending and business investment. The Tax Foundation estimates that Trump’s tariffs could cost U.S. consumers billions annually. Meanwhile, robust job growth—228,000 jobs added in March 2025—has done little to assuage fears, as the data predates the latest tariff escalations.

Breaking news updates indicate that Trump is set to meet with major retailers today to discuss tariff impacts, a move that underscores the growing pressure on businesses. Investors are also eyeing upcoming corporate earnings from megacap stocks like Tesla and Alphabet, which could provide clues on how companies are navigating the trade war. However, market strategists caution that forward-looking guidance will be critical, as tariffs are expected to weigh heavily on profit margins.

Global markets are not immune to the turmoil. European stocks have fallen 4%, and Asian markets, though partially closed for holidays, are bracing for further declines. Safe-haven assets like gold are rallying, with prices hitting record highs, while the 10-year Treasury yield has dipped below 4%, reflecting a flight to bonds amid economic uncertainty.

As Wall Street navigates this volatile landscape, the interplay of Trump’s trade policies, his attacks on Powell, and the Federal Reserve’s response will likely dictate market direction in the coming weeks. For now, investors remain on edge, bracing for further swings in a market gripped by fear and uncertainty.

Sources

- https://youtu.be/IWrPzQx1vjg

- https://youtu.be/jSyh4LNBnfs

- https://www.reuters.com/markets/wall-st-slumps-trump-renews-tirade-against-feds-powell-2025-04-21/

- https://www.cnbc.com/2025/04/20/dow-drops-1100-points-sp-500-loses-3percent-as-trumps-powell-attacks-add-to-investors-concerns-live-updates.html

- https://www.cbsnews.com/news/dow-jones-plunges-2200-points-tariff-tumult-2025-04-04/

- https://www.investopedia.com/markets-news-april-9-2025-dow-jumps-3000-points-nasdaq-soars-12-percent-as-trump-pauses-tariffs-8632790

- https://www.reuters.com/markets/powell-says-trump-tariffs-larger-than-expected-likely-boost-inflation-slow-growth-2025-04-04/