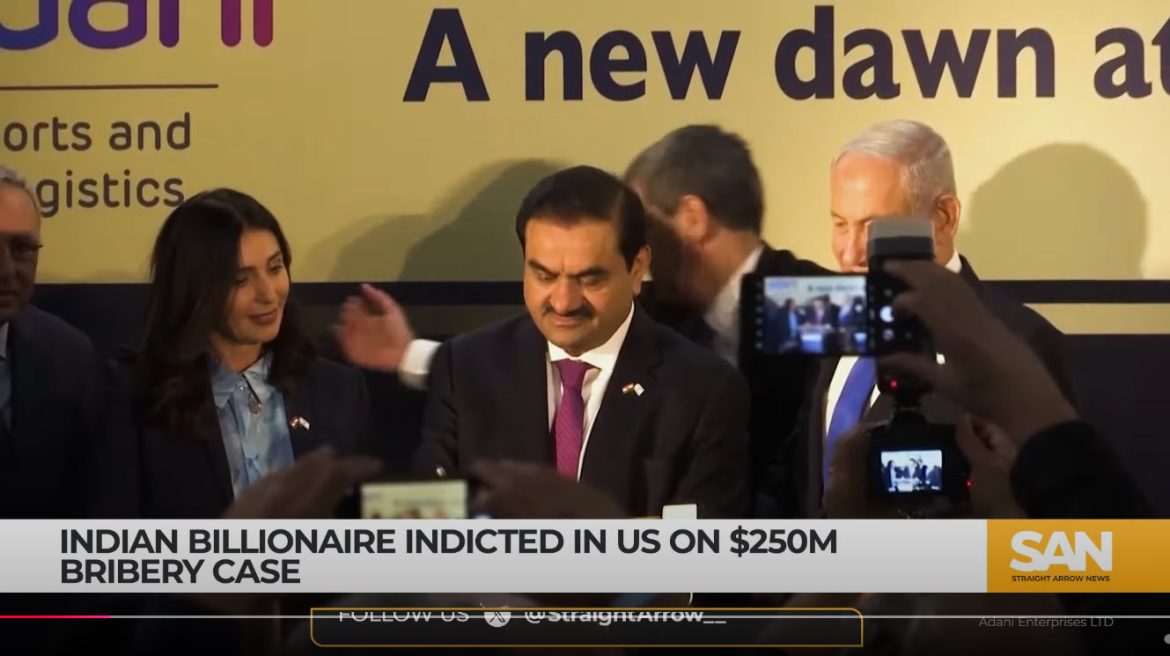

U.S. federal prosecutors have indicted Indian billionaire Gautam Adani and seven associates on charges of orchestrating a $250 million bribery scheme to secure favorable terms on solar power contracts in India. The indictment alleges that between 2020 and 2024, Adani and his co-defendants paid substantial bribes to Indian government officials to obtain contracts projected to yield over $2 billion in profits.

The charges, unsealed in the Eastern District of New York, include conspiracy to commit securities fraud, wire fraud, and violations of the Foreign Corrupt Practices Act. Prosecutors assert that Adani and his associates concealed the bribery scheme from U.S. investors and financial institutions, raising over $3 billion through loans and bond offerings based on false representations. The indictment also accuses the defendants of obstructing investigations by deleting emails and providing false information to authorities.

Following the announcement of the charges, shares of Adani Group companies experienced significant declines, with the conglomerate losing approximately $26 billion in market value. Adani Enterprises saw a 23% drop in its stock price, while other entities such as Adani Ports & Special Economic Zone and Adani Green Energy also faced substantial losses.

Adani Group has denied the allegations, labeling them as baseless. In a statement, the conglomerate asserted its commitment to legal compliance and transparency, expressing confidence that the judicial process would vindicate them. The group also emphasized its ongoing cooperation with authorities and its dedication to ethical business practices.

This indictment marks a significant development in the scrutiny of Adani Group, which has previously faced allegations of fraud and market manipulation. In January 2023, Hindenburg Research accused the conglomerate of engaging in stock manipulation and accounting fraud, leading to a substantial decline in Adani’s net worth. The current charges may further impact the group’s operations and its standing in global markets.

The defendants are expected to appear in U.S. federal court to face the charges. If convicted, they could face significant fines and imprisonment. The case underscores the U.S. government’s commitment to enforcing anti-corruption laws and holding foreign nationals accountable for fraudulent activities that affect U.S. investors and financial institutions.