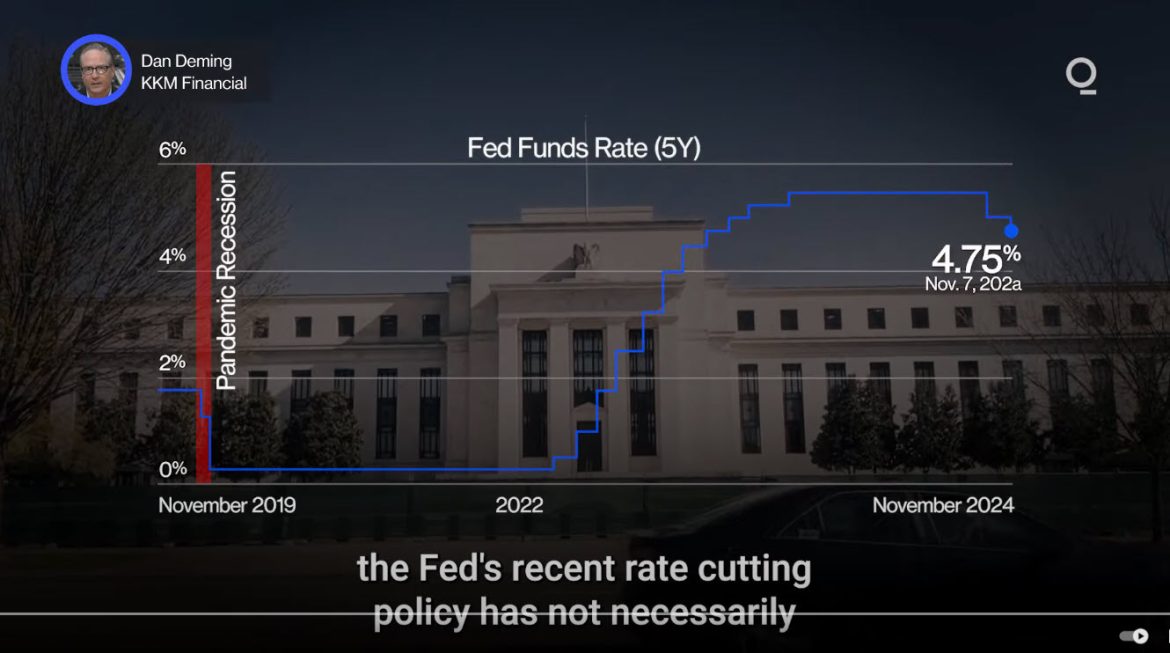

In a surprising turn of events, the Federal Reserve’s recent rate cuts have failed to provide relief to millions of American homeowners and prospective buyers. Despite the Fed lowering its official rate to 4.75% from 5.5% in two separate cuts this year, mortgage rates have paradoxically increased, leaving many to question the effectiveness of the central bank’s monetary policy.

The Fed’s decision to cut rates for the first time in four years was widely anticipated as a move to stimulate economic growth and ease borrowing costs. However, the approximately 85 million holders of residential mortgages in the United States have yet to see the benefits of this policy shift. Instead, they face the perplexing reality of rising retail lending rates.

Experts point to several factors contributing to this disconnect between Fed policy and mortgage rates. One key element is the complex interplay between short-term interest rates, which the Fed directly influences, and long-term rates that govern most mortgages. Michael Feroli, the chief U.S. economist at J.P. Morgan, notes that “while the Fed’s actions typically influence short-term rates, mortgage rates are more closely tied to long-term bond yields, which can be affected by various market forces beyond the Fed’s control.”

The real estate market’s response to the rate cuts has been particularly notable. David Russell, global head of market strategy at Tradestation, suggests that “decreased inflation will enhance profitability for sectors sensitive to economic changes, but the translation to lower mortgage rates isn’t immediate”. This lag in market adjustment has left many homeowners and potential buyers in a state of limbo.

Adding to the complexity, the commercial real estate sector is experiencing its own set of challenges. While the Fed’s rate cuts were expected to increase bank profitability and ease lending conditions, the actual impact has been muted. Projects that once seemed viable are now struggling to pencil out, and transaction volumes have declined.

For first-time homebuyers, the situation is particularly frustrating. The anticipated boost in borrowing capacity from lower Fed rates has been offset by increased competition in the market, pushing home prices higher. This has created a catch-22 situation where the very policy intended to make homeownership more accessible may be contributing to its elusiveness.

The disconnect between Fed policy and mortgage rates raises questions about the efficacy of monetary policy in the current economic landscape. As Robert R. Johnson, CEO of Economic Index Associates, points out, “Historically, equities perform better when the Fed is lowering rates rather than raising them.” However, the unusual behavior of mortgage rates in this cycle suggests that traditional economic models may need reevaluation.

Looking ahead, market participants are closely watching for signs of further rate cuts. Current projections suggest the Fed may lower rates by an additional 1.5% over the next six months, potentially bringing the Fed funds rate down to 3.25%3. Whether these future cuts will finally trickle down to mortgage holders remains to be seen.

As the situation unfolds, homeowners and prospective buyers are advised to stay informed and consult with financial experts. The complex interplay between Fed policy, market forces, and lending practices underscores the need for a nuanced understanding of the real estate landscape in these uncertain times.