The Internal Revenue Service (IRS) is preparing to send payments of up to $1,400 to over a million taxpayers across the United States in a move aimed at addressing discrepancies and delays in stimulus payment distribution. The payments, expected to roll out in the coming weeks, are part of a broader effort to ensure that eligible Americans receive funds they may have missed during the initial rounds of pandemic-related stimulus checks.

These payments stem from unclaimed or adjusted stimulus amounts authorized under the American Rescue Plan Act. The $1,400 checks were distributed in 2021 as the third round of economic impact payments, designed to provide financial relief during the COVID-19 pandemic. However, various factors, including changes in taxpayer information, incorrect filings, and administrative errors, resulted in some eligible individuals not receiving their full payments.

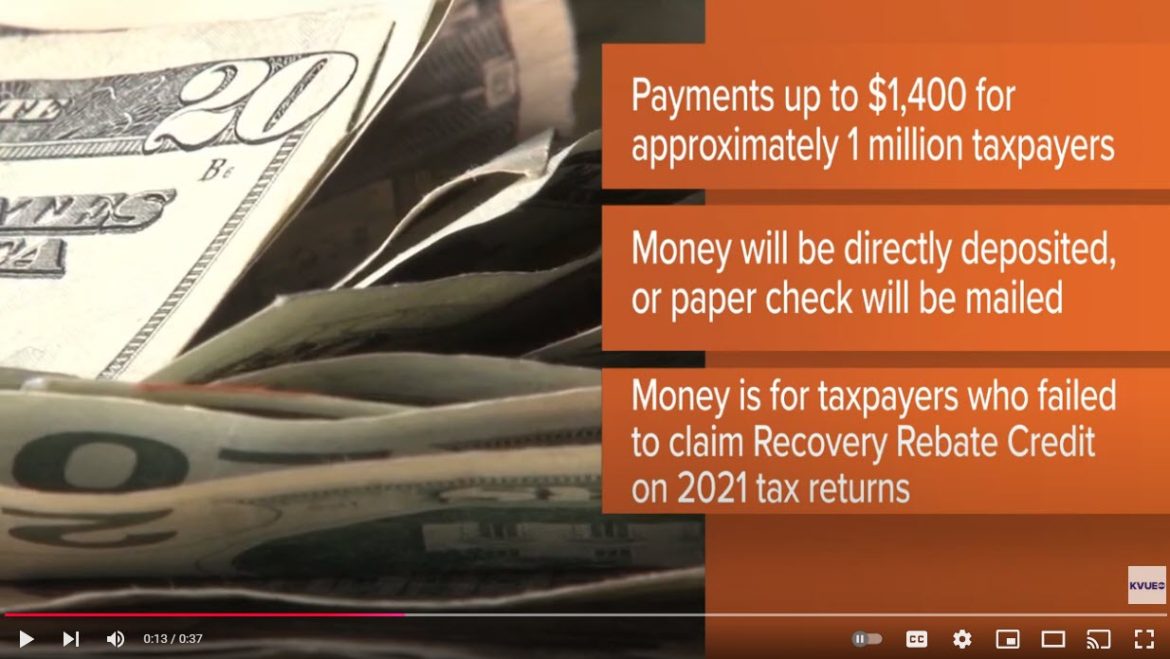

The IRS has identified these discrepancies through routine audits and taxpayer submissions of amended returns. Taxpayers who filed their 2021 tax returns and claimed missing stimulus payments using the Recovery Rebate Credit are among those eligible for the forthcoming payouts. Additionally, individuals whose eligibility was retroactively confirmed due to changes in income, filing status, or dependent information may also qualify.

To streamline the process, the IRS is automatically issuing these payments to qualified taxpayers. No additional action is required for those identified as eligible, though individuals are encouraged to verify their tax records to ensure they are accounted for. Taxpayers who believe they qualify but have not been notified should contact the IRS or consult their tax preparer for guidance.

The announcement comes as part of the IRS’s ongoing commitment to resolve outstanding issues related to pandemic-era relief programs. For many recipients, these payments could provide much-needed financial support as inflation and economic challenges continue to impact households nationwide.

While the payments are welcomed by eligible taxpayers, they have also reignited discussions about the effectiveness of large-scale stimulus programs and the administrative challenges associated with distributing funds to millions of Americans. Advocacy groups praise the IRS’s efforts to correct errors, but some critics argue that delays in addressing these discrepancies have caused unnecessary hardship for families.

As the IRS works to distribute the payments, taxpayers are reminded to ensure their contact information and tax filings are up to date to avoid delays or issues with future refunds and credits. For many, this additional payment represents not just financial relief but a resolution to lingering concerns over missed stimulus checks.