The U.S. Department of Justice (DOJ) is imposing new restrictions on the Department of Government Efficiency (DOGE), limiting its access to federal payment systems managed by the Treasury Department. This decision follows mounting legal and political pressure over concerns about data security and potential conflicts of interest.

Under the new restrictions, two special government employees affiliated with DOGE will retain read-only access to the Treasury’s federal payment system but will no longer have the ability to modify or initiate transactions. This move comes in response to a lawsuit filed by multiple federal employee unions against Treasury Secretary Scott Bessent and the agency, seeking to block billionaire Elon Musk and other DOGE-affiliated personnel from accessing sensitive government financial systems.

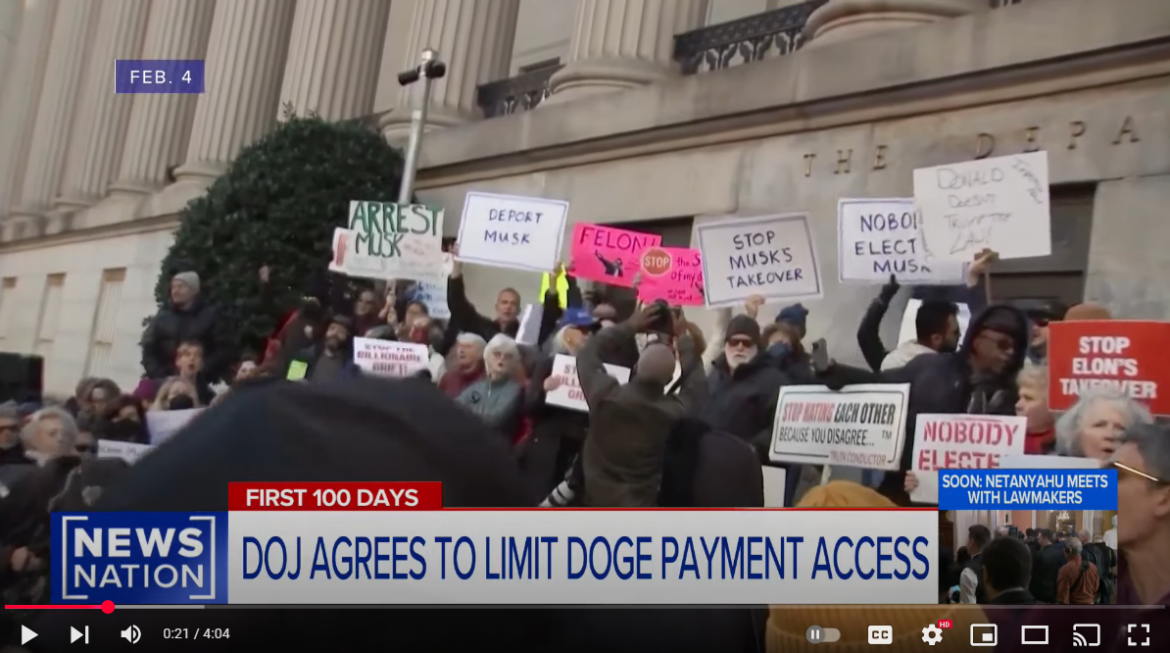

Union leaders argue that Bessent improperly granted Musk’s associates access to highly confidential financial data, including personal and payment records of federal employees and contractors. They contend that such access violates privacy regulations and exposes the federal payment system to undue influence by individuals with private-sector ties. The lawsuit also raises concerns about whether DOGE, initially created to streamline government operations, is being used to advance external business interests rather than public service objectives.

The Justice Department’s move signals an effort to mitigate these concerns while still allowing limited oversight capabilities for DOGE officials. The Treasury Department has not issued an official response but has previously defended DOGE’s role in ensuring financial efficiency within federal agencies.

Musk, who has been an outspoken advocate for increased government efficiency, has not directly commented on the decision. However, sources close to DOGE suggest that he and his allies view the move as a politically motivated attempt to stifle innovation within government operations. Critics of the DOJ’s actions argue that restricting DOGE’s access could slow down much-needed reforms in federal financial systems.

The legal battle over DOGE’s involvement in federal payment systems is expected to continue, with union representatives pushing for stricter oversight of private-sector influence in government operations. The case has also drawn attention to the broader issue of how technology entrepreneurs and business leaders interact with federal agencies in shaping financial and operational policies.