A recent survey conducted by the Center for Responsible Lending reveals that a significant majority of Americans across the political spectrum support the Consumer Financial Protection Bureau (CFPB). Approximately 67% of respondents express a favorable view of the agency, with support spanning 60% of Republicans and 84% of Democrats.

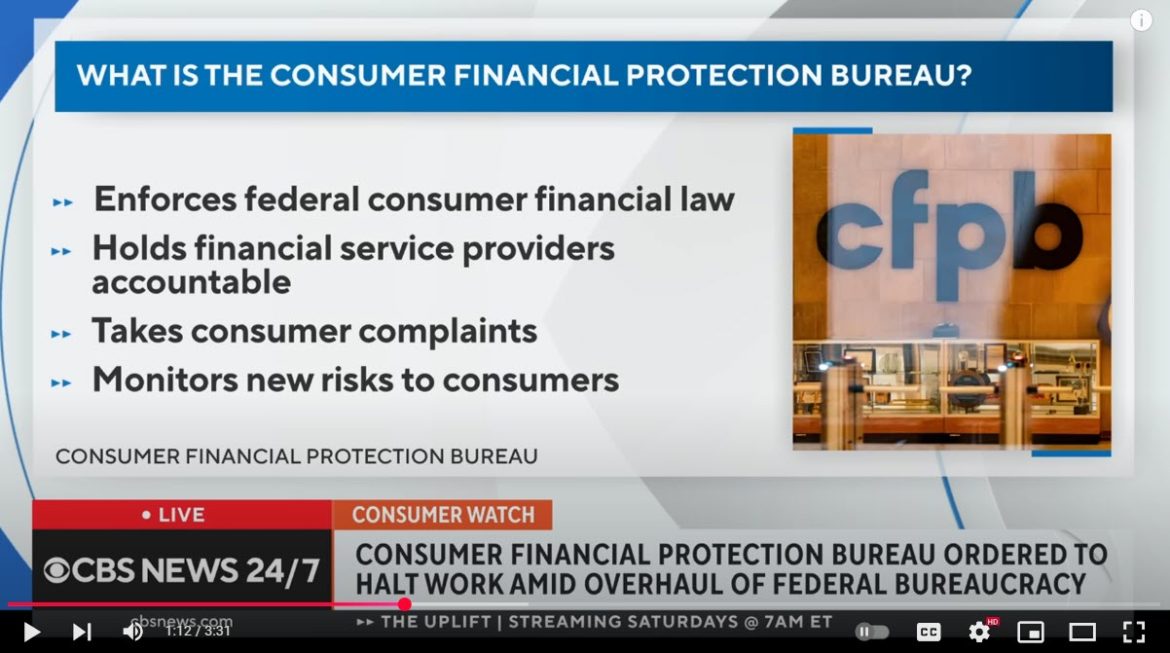

Established under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the CFPB serves as a federal watchdog overseeing financial institutions to protect consumers from unfair practices. Its responsibilities include enforcing federal consumer financial laws and ensuring fairness in the financial marketplace.

Despite public support, the CFPB is currently embroiled in administrative challenges. In early February, the Trump administration ordered the agency to halt nearly all operations, effectively shutting down its headquarters. This directive has led to halted enforcement actions, jeopardized data, and canceled contracts, causing internal confusion among staff.

The National Treasury Employees Union (NTEU), representing CFPB employees, has filed a lawsuit against the administration’s actions, arguing that the shutdown violates the agency’s statutory obligations. Internal communications reveal that CFPB officials are seeking clarity on the agency’s future, while the administration maintains that a more streamlined bureau will continue to operate.

The administration’s decision to halt CFPB operations has also impacted consumers awaiting financial redress. For instance, a $100 million compensation fund for borrowers allegedly harmed by student loan servicer Navient remains undistributed due to the agency’s work stoppage. Similar payouts from companies like Block (parent company of Cash App), TD Bank, and Honda’s lending arm are also in limbo, as CFPB authorization is required to process these payments.

The CFPB’s future remains uncertain as legal proceedings continue. The administration has nominated Jonathan McKernan, a former board member of the Federal Deposit Insurance Corporation (FDIC), to lead the agency, signaling an intention to maintain its operations in some capacity. However, the extent of the bureau’s authority and functionality under new leadership is yet to be determined.

Sources:

- New Poll Shows Strong, Bipartisan Support for Consumer Bureau

- The CFPB | Consumer Financial Protection Bureau

- Trump administration orders consumer protection agency to stop work

- Email trove reveals CFPB turmoil after Vought’s work stoppage

- Consumer watchdog payouts in limbo as agency defanged by Trump administration

- Trump admin denies plans to shutter CFPB, court papers say