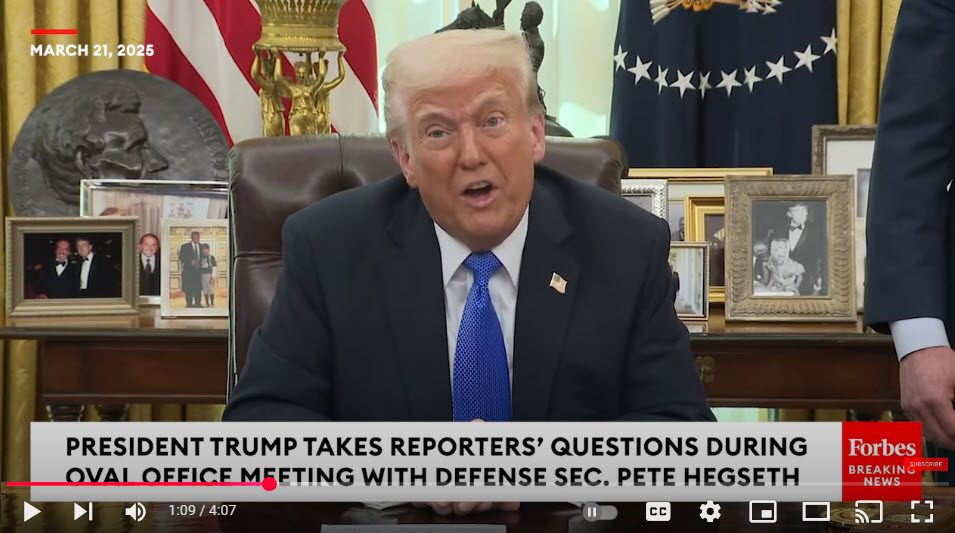

President Donald Trump announces that on April 2, the United States will officially implement new tariffs on imports from Canada, Mexico, and China. Speaking from the Oval Office, Trump refers to this date as America’s “Liberation Day,” asserting that these measures will ignite an economic boom and restore American industrial power. The new policy includes a 25% tariff on select imports from Canada and Mexico and a 10% tariff on goods coming from China.

Trump emphasizes that the anticipation of these tariffs has already influenced corporate behavior, with multiple companies announcing plans to relocate production plants back to the United States. He states, “Americans will see an economic boom after the tariffs,” claiming that the move will bring jobs back home and reduce reliance on foreign manufacturing.

The administration frames the tariffs as a response to years of what it describes as unfair trade practices, illegal immigration facilitated through weak border economies, and intellectual property theft. Trump’s advisors point to similar trade policies from his first term, such as the China trade war of 2018–2019, as foundational experiences leading up to this more targeted strategy.

The announcement has drawn swift international attention. In response, the European Union, which previously announced retaliatory tariffs on U.S. goods including whiskey and apparel, has decided to delay their implementation until mid-April. EU officials say the pause allows more room for diplomatic talks while maintaining pressure on the U.S. to adjust its policies.

An EU spokesperson emphasizes that the delay does not reduce the seriousness or impact of the European response. Meanwhile, EU Trade Commissioner Maroš Šefčovič is scheduled to meet U.S. Commerce Secretary Howard Lutnick in Washington on March 25 for further negotiations. The transatlantic talks are seen as a critical test for whether the looming trade rift can be defused before it escalates into a full-scale tariff war.

Domestically, reaction to the tariffs is mixed. While American manufacturers and economic nationalists praise the move as a long-overdue correction to trade imbalances, others—particularly in the retail and agricultural sectors—fear price increases, supply chain disruptions, and retaliatory measures that could harm U.S. exports.

Stock markets show cautious optimism, as investors speculate that Trump may eventually soften the tariffs or narrow their scope depending on global reaction. Still, concerns persist about potential ripple effects across key sectors, especially as both China and Mexico consider their own retaliatory steps.

This latest round of tariffs signals a hardline approach to global trade that aligns with Trump’s broader “America First” economic doctrine. As April 2 approaches, all eyes turn to the global stage to see whether the economic standoff will spark a new wave of negotiations or deepen existing divides.

Sources:

https://www.whitehouse.gov/fact-sheets/2025/02/fact-sheet-president-donald-j-trump-imposes-tariffs-on-imports-from-canada-mexico-and-china

https://www.reuters.com/markets/europe/eu-may-delay-first-set-counter-tariffs-against-us-mid-april-2025-03-20

https://www.reuters.com/world/europe/eu-trade-commissioner-meet-us-commerce-secretary-lutnick-tuesday-2025-03-24

https://www.reuters.com/markets/europe/global-markets-view-europe-2025-03-24

https://www.businessinsider.com/stock-market-today-sp500-trump-april-tariffs-trade-war-tech-2025-3

https://www.investors.com/news/economy/trump-tariffs-reciprocal-april-2-targets-narrow-sp-500

https://youtu.be/cgeOpQjc2d0

https://youtu.be/47ac_sGtQU4