U.S. stocks plunge across the board following stark warnings from Federal Reserve Chair Jerome Powell that ongoing and proposed tariffs could pose significant challenges to inflation control and economic growth. Speaking Thursday at the Economic Club of Chicago, Powell cautions that the central bank may face a difficult balancing act as protectionist trade measures begin to pressure consumer prices and disrupt global supply chains.

Powell says tariffs—both existing and anticipated—are likely to increase costs for American businesses and households, potentially reversing recent gains in inflation moderation. “We may find ourselves in a situation where our dual mandate goals are in tension,” he tells the business audience, referencing the Fed’s objectives to both stabilize prices and support maximum employment. “Restrictive trade policies can complicate our efforts to lower inflation in a sustainable way without hurting growth.”

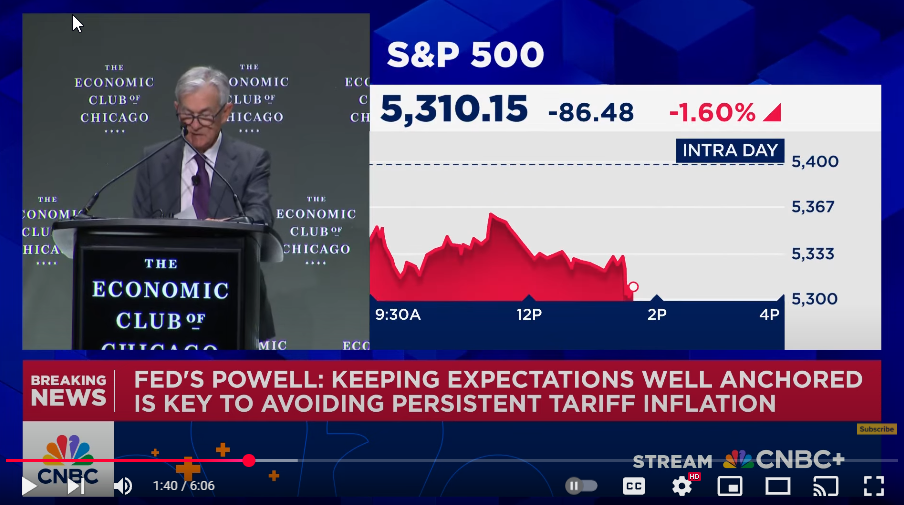

Following Powell’s remarks, Wall Street reacts swiftly and sharply. The Dow Jones Industrial Average plummets more than 900 points, while the S&P 500 drops over 3%. The Nasdaq Composite falls by more than 700 points, marking one of its worst single-day declines this year. Financial analysts say the reaction reflects deep concern among investors that new tariffs—especially those targeting Chinese goods and European imports—could reignite price pressures and force the Fed to keep interest rates higher for longer.

Recent White House policy shifts have reignited global trade tensions. Earlier this month, the administration announced a new round of tariffs on certain technology and automotive imports, aimed at curbing what it calls “unfair trade practices” by China and other countries. These measures come as a growing number of American manufacturers report increased costs for inputs, and consumer advocates warn that prices on electronics, appliances, and vehicles may soon spike.

Powell stops short of directly criticizing trade policy decisions but makes clear that the Fed is monitoring the situation closely. “Tariffs are ultimately a form of tax on consumers,” he says. “While they may protect domestic industries in the short term, they often increase the prices Americans pay and can reduce the economy’s overall efficiency.”

Economists warn that the effects of tariffs on inflation may appear gradually but could prove persistent. If inflationary pressures resurge while economic growth stalls, the central bank could be forced into a difficult policy corner—raising rates to curb prices at the risk of triggering a slowdown or even recession.

The Fed has held rates steady in recent months after a series of hikes aimed at bringing inflation back to its 2% target. While recent data showed signs of cooling inflation, Powell’s comments suggest the central bank is not ruling out further tightening if global developments make price stability more elusive.

Market watchers also express concern that renewed inflation fears could damage investor confidence just as markets were showing signs of recovery after a rocky start to the year. Technology stocks, which are particularly sensitive to interest rate outlooks, are among the hardest hit in Thursday’s selloff. Major tech firms including Apple, Nvidia, and Microsoft see losses between 4% and 6% on the day.

In Washington, some lawmakers are already pushing back against Powell’s remarks. Senator Josh Hawley (R-MO), a vocal advocate of protectionist policies, says tariffs are necessary to protect U.S. jobs and national interests. “The Fed is out of touch if it thinks we should sacrifice American workers on the altar of cheap imports,” Hawley posts on X.

Meanwhile, international markets are also roiled by the developments. European and Asian stock indexes open sharply lower on Friday, as fears of a global trade slowdown ripple through financial systems.

As Powell’s comments continue to reverberate, all eyes turn to the Fed’s next policy meeting in June. Investors and economists alike are eager for more clarity on whether the Fed will resume rate hikes, or attempt to navigate what Powell describes as an “increasingly complex” economic environment influenced by both domestic and geopolitical forces.