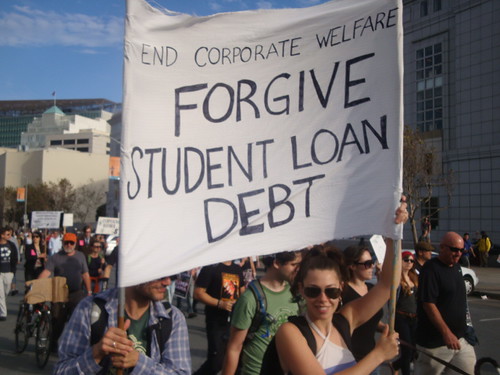

A recent poll conducted by Intelligent-dot-com has shed light on the financial predicament faced by student loan borrowers in the United States. The survey reveals that over a third of these borrowers had spent money with the belief that their debt would be forgiven under President Biden’s student loan forgiveness plan. However, the Supreme Court has since declared that the President lacks the authority to unilaterally cancel a significant amount of consumer debt without explicit authorization from Congress. As a result, more than half of the respondents expressed their unpreparedness for the restart of loan payments in October, further exacerbating their financial concerns.

Understanding Borrowers’ Expectations:

The poll conducted by Intelligent-dot-com underscores the extent to which student loan borrowers were banking on the promised relief under President Biden’s loan forgiveness plan. With nearly 35% of respondents admitting to having spent money under the assumption that their debt would be forgiven, it is evident that these borrowers had placed significant trust in the proposed program. The President’s plan aimed to alleviate the burden of student loan debt, providing a fresh start for millions of Americans struggling with financial obligations.

The Supreme Court’s Ruling:

However, the Supreme Court’s ruling has dealt a blow to the hopes and expectations of these borrowers. The highest court in the land declared that the President does not possess the authority to unilaterally cancel a substantial amount of consumer debt without the explicit approval of Congress. This ruling not only halted the implementation of the proposed loan forgiveness plan but also created uncertainty and financial anxiety among borrowers who were relying on it. The court’s decision emphasizes the importance of the separation of powers and the need for legislative action to bring about significant changes in the realm of student loan forgiveness.

Unpreparedness for Loan Repayment:

The poll also highlighted that over 50% of respondents are unprepared for the imminent resumption of loan payments scheduled for October. This lack of preparedness can be attributed to the borrowers’ misplaced confidence in the loan forgiveness plan, leading them to allocate their financial resources differently. As the deadline approaches, these borrowers now find themselves grappling with the reality of having to resume loan payments without the anticipated relief.

Implications for Student Loan Borrowers:

The Supreme Court’s ruling and the subsequent unpreparedness of borrowers have significant implications for those burdened by student loan debt. The sudden reactivation of loan repayment plans without the anticipated forgiveness option places borrowers in a precarious financial situation. Many may struggle to meet their monthly obligations, facing potential consequences such as increased financial strain, default, or even bankruptcy.

Way Forward and Legislative Action:

In light of these developments, it becomes imperative for both the Biden administration and Congress to explore alternative avenues to address the mounting student loan crisis. While the President’s original plan faced legal obstacles, there remains an urgent need to find feasible solutions that can alleviate the burden on borrowers and promote financial stability. Collaborative efforts between the executive and legislative branches should be undertaken to formulate and implement comprehensive policies that address the systemic issues plaguing the student loan landscape.

Conclusion:

The Intelligent-dot-com poll highlights the disillusionment and financial uncertainty experienced by student loan borrowers following the Supreme Court’s ruling on the authority of the President to cancel consumer debt. The unpreparedness of over half the respondents for the restart of loan payments in October underscores the need for proactive measures to alleviate the burdens faced by borrowers. It is now crucial for policymakers to come together, explore alternative solutions, and take decisive action to address the escalating student loan crisis in a manner that promotes financial stability and relieves the burden on millions of Americans striving to attain higher education.