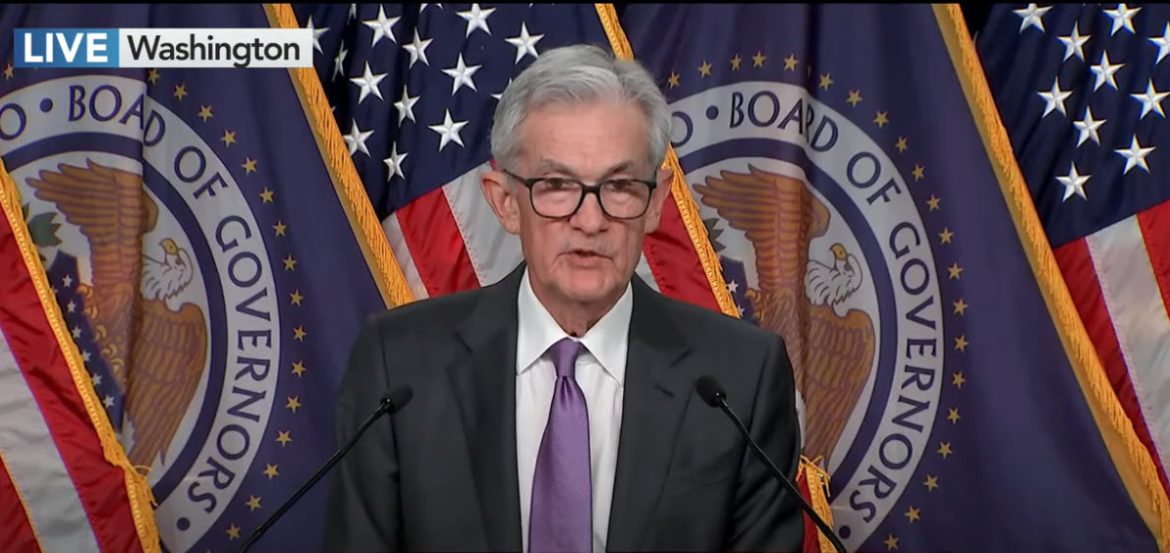

The Federal Reserve has announced its decision to keep interest rates unchanged for the time being but hinted at possible rate cuts later this year. This decision marks a significant development in the central bank’s strategy amid ongoing concerns about inflation and economic stability.

According to the Federal Reserve, while inflation has eased somewhat, it remains at elevated levels. Federal Reserve Chair Jerome Powell emphasized the importance of bringing inflation down to the target rate of two percent for a sustainable and robust labor market.

The current federal funds rate stands at its highest level in over 23 years, reflecting the Federal Reserve’s cautious approach to monetary policy in light of economic uncertainties. Powell highlighted that any decision to cut rates would be carefully weighed to avoid potential risks such as a resurgence of inflation or increased unemployment.

Wall Street reacted positively to the Federal Reserve’s announcement, with the Dow Jones Industrial and S&P 500 reaching all-time highs. Investors responded favorably to the indication of potential rate cuts later in the year, signaling confidence in the central bank’s ability to navigate economic challenges.

During a press conference, Powell acknowledged the complexity of the economic landscape, describing the path toward lower inflation as a “sometimes bumpy road.” He noted that recent data have shown higher inflationary trends, particularly in indicators like the consumer price index and personal consumption expenditure.

Powell reiterated the Federal Reserve’s commitment to achieving its inflation target while maintaining a strong labor market. He cautioned against premature rate cuts that could fuel inflationary pressures but also highlighted the risks of delaying rate adjustments, which could impact unemployment levels.

Overall, the Federal Reserve’s decision to keep interest rates steady reflects its cautious optimism about the economic recovery while remaining vigilant about inflationary pressures. The central bank’s forthcoming rate cuts, if implemented, will be closely monitored for their impact on economic growth and stability.