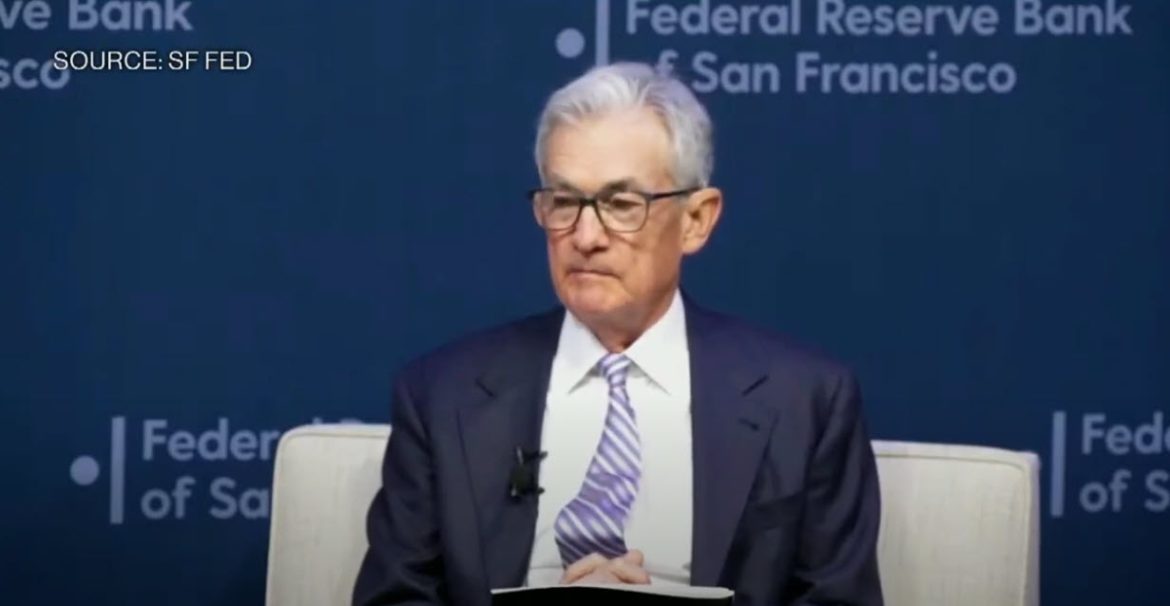

Federal Reserve Chair Powell Assesses Inflation Data

Federal Reserve Chairman Jerome Powell has commented on the latest inflation data, indicating that it aligns with the central bank’s expectations. Speaking from San Francisco, Powell emphasized that any decision to lower interest rates would depend on the Federal Reserve’s confidence in inflation moving towards its targeted goal of two percent.

The statement from Powell comes in response to the recent release of the Commerce Department’s Personal Consumption Expenditures (PCE) price index. According to this data, prices rose by three-tenths of a percent last month. This figure falls within the range anticipated by the Federal Reserve, suggesting stability in inflation trends.

Despite acknowledging the inflation data, Powell noted that it would not be appropriate to consider lowering interest rates until there is a clear indication that inflation is progressing towards the Fed’s target. This cautious approach reflects the Federal Reserve’s commitment to maintaining a balance between economic growth and price stability.

Experts interpret Powell’s remarks as signaling a potential slowdown in the pace of interest rate cuts this year. The alignment of inflation data with expectations indicates a degree of economic stability, which could influence the Federal Reserve’s monetary policy decisions in the coming months.

Chairman Powell’s statements highlight the importance of monitoring inflation trends closely. The Federal Reserve will continue to assess economic indicators and adjust its policy stance accordingly to support sustainable economic growth and price stability.

Federal Reserve Chair Jerome Powell’s assessment of the latest inflation data reflects cautious optimism about the economy’s trajectory. While inflation remains a key consideration, Powell’s remarks suggest a measured approach to interest rate adjustments, prioritizing economic stability and the Fed’s long-term goals.