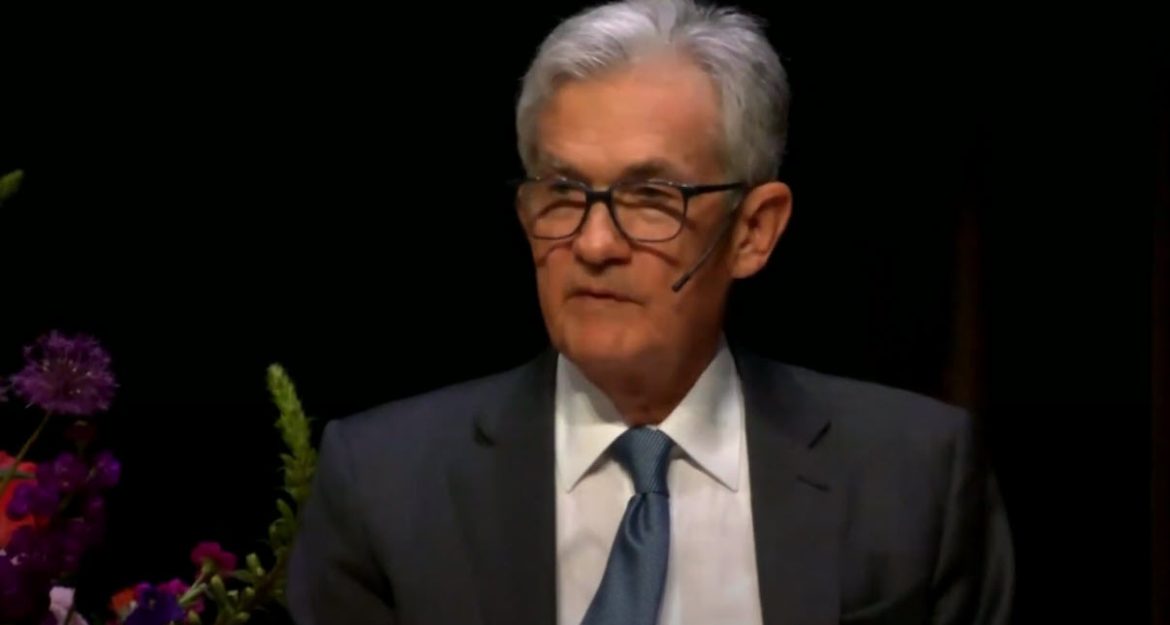

Federal Reserve Chair Jerome Powell announces that interest rates are expected to hold steady, quashing hopes for a reduction anytime soon. Speaking at the Foreign Bankers Association in Amsterdam on Tuesday, Powell emphasized that recent inflation readings have been higher than anticipated, necessitating a patient approach from the Fed.

Powell highlighted that the Federal Reserve needs to allow its restrictive policy to take full effect to bring inflation down to manageable levels. Despite the challenging inflation environment, he also indicated that a rate hike is unlikely based on current data, suggesting that the Fed will maintain its key borrowing rate at 5.5%, the highest level in over two decades.

This announcement aligns with the Fed’s strategy of sustaining high interest rates to curb inflation, even as the economy shows signs of strain. Powell’s remarks come amidst widespread concern over rising prices, particularly for essential goods and services.

(New York, NY) — A recent survey by the New York Federal Reserve reveals that many Americans remain pessimistic about the prospects for inflation, with consumer expectations for both short-term and long-term price increases rising. The survey, conducted in April, points to higher prices for homes, fuel, and energy as significant contributors to the bleak inflation outlook.

These findings precede the release of the closely watched consumer price index (CPI), which will provide further insights into the inflationary trends affecting the economy. The CPI data is crucial for the Fed’s assessment of inflation and its subsequent monetary policy decisions.

Powell’s firm stance on maintaining the current interest rate level is reflective of the Fed’s commitment to its inflation targets. By keeping rates high, the Fed aims to slow economic activity enough to reduce inflationary pressures without tipping the economy into a recession. However, this balancing act is fraught with challenges, as persistent inflation and high borrowing costs continue to impact both consumers and businesses.

Market reactions to Powell’s speech have been mixed. While some investors appreciate the Fed’s clear communication and commitment to tackling inflation, others express concerns about the potential economic slowdown and its effects on market stability.

The Fed’s cautious approach underscores the complex economic environment marked by post-pandemic recovery challenges, supply chain disruptions, and geopolitical tensions. These factors contribute to the ongoing inflationary pressures that the Fed aims to mitigate through its monetary policy.

As the Fed navigates these economic headwinds, its decisions will be closely scrutinized by policymakers, economists, and the public. Powell’s emphasis on patience and the effectiveness of restrictive policies highlights the Fed’s long-term strategy to stabilize the economy and achieve its inflation targets.