U.S. stocks are experiencing a sharp decline, reflecting widespread concerns over a global and national economic slowdown. The downturn on Wall Street follows a massive global market sell-off fueled by fears of a looming recession in the United States.

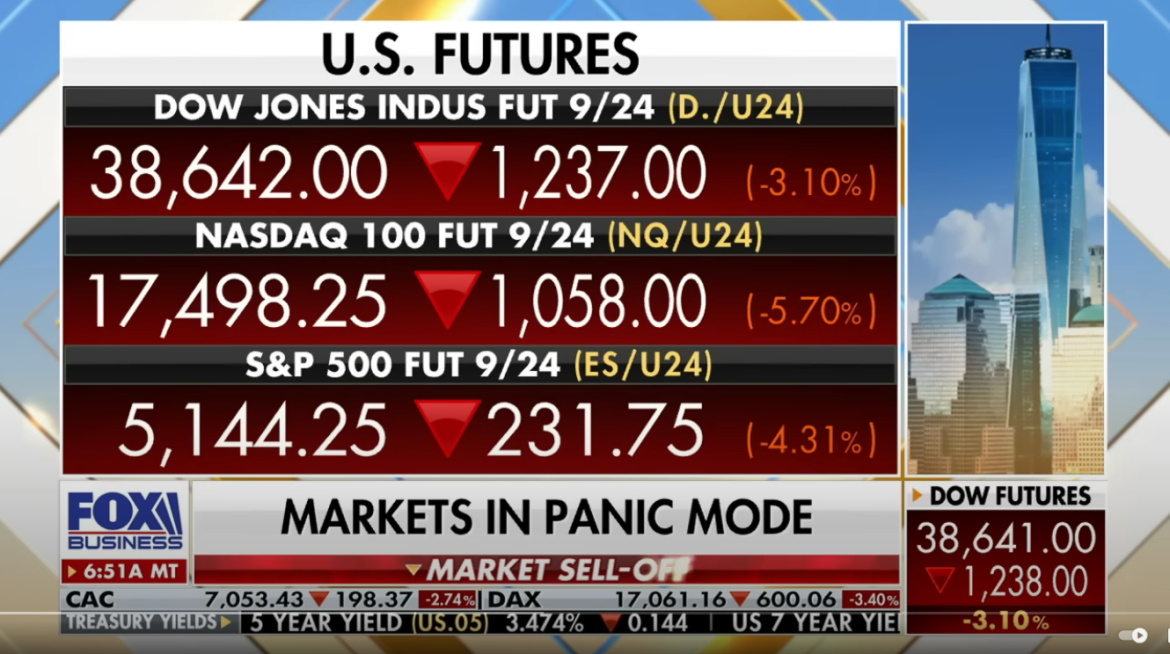

At the opening bell, the Dow Jones Industrial Average tumbled over 1,100 points, setting a grim tone for the trading session. Similarly, the S&P 500 fell more than 3%, and the Nasdaq, heavily populated with high-risk tech stocks, plummeted over 800 points. The broader market is on track to plunge 4.5% by the end of the day, while the Nasdaq is set to drop a staggering 6%, underscoring the severe volatility and investor anxiety gripping financial markets worldwide.

The sell-off is not confined to the U.S.; global stock markets are also reeling from the impact of the feared economic slowdown. Investors are reacting to a series of troubling economic indicators, including disappointing U.S. manufacturing data, weakening consumer confidence, and rising concerns about inflationary pressures. These factors are contributing to a heightened sense of uncertainty about the future trajectory of the U.S. economy.

In the wake of these developments, financial experts are issuing stark warnings about the state of the market. “It’s getting ugly real fast out there,” cautioned a leading finance analyst, underscoring the speed and severity of the market’s downturn. The statement reflects a growing consensus among economists and market watchers that the current conditions could lead to a prolonged period of economic instability.

The Dow’s dramatic drop of 1,300 points at the start of trading highlights the scale of investor panic. This decline marks one of the most significant single-day point losses in recent history, evoking memories of past financial crises. The broader implications of this sell-off are being closely monitored by policymakers, investors, and businesses alike, as they brace for potential ripple effects across the global economy.

Tech stocks, which have been particularly vulnerable, are bearing the brunt of the sell-off. The Nasdaq’s anticipated 6% drop is a clear indication of the market’s aversion to risk amid the current economic uncertainty. High-growth tech companies, which have previously enjoyed robust valuations, are now facing intense scrutiny and sell-offs as investors seek safer havens for their capital.

The ongoing market turmoil is exacerbated by a series of geopolitical tensions and trade uncertainties. The interplay of these factors with the domestic economic challenges is creating a complex and volatile environment for investors. The Federal Reserve’s monetary policy stance, aimed at combating inflation while supporting economic growth, is also under the spotlight as market participants await further guidance and potential interventions.

As the trading day progresses, market participants remain on edge, closely watching for any signs of stabilization or further deterioration. The financial community is calling for coordinated efforts from global policymakers to address the underlying economic issues and restore investor confidence.

The coming days and weeks will be critical in determining the direction of the markets and the broader economy. Stakeholders are urged to stay informed and prepared for continued volatility as the situation unfolds.