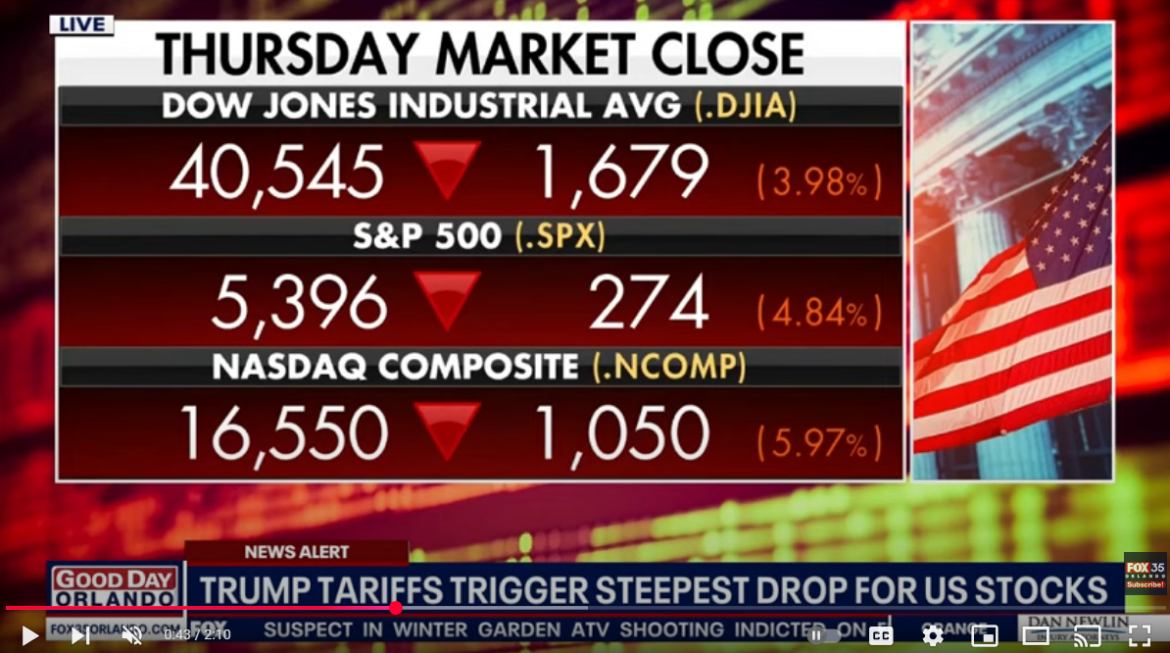

Stocks continue their sharp descent for a second consecutive day as President Donald Trump’s sweeping global tariff announcement sends shockwaves through international markets and stokes fears of a looming U.S. recession. The Dow Jones Industrial Average plunges by over 2,000 points in midday trading, marking one of the steepest two-day declines in recent memory. The Nasdaq Composite and S&P 500 also spiral downward, each losing more than five percent at various points Friday.

The turmoil follows President Trump’s sudden imposition of broad new tariffs on nearly every foreign trading partner earlier this week. The move is intended, according to administration officials, to combat what they describe as years of unfair trade practices, including the use of slave labor and artificially low pricing by foreign manufacturers.

In a statement Friday morning, White House deputy chief of staff Stephen Miller downplays the staggering market drop, calling it “temporary” and insisting that the U.S. is finally taking a stand after decades of being “ripped off” by global competitors. “America gets to set the rules for trade,” Miller declares in a Fox Business interview, emphasizing that the U.S. consumer market gives Washington leverage that no other nation can match. Miller reiterates a hardline stance, arguing that too many countries exploit labor conditions abroad and dump cheap goods into American markets.

Investors, however, react with alarm. The Dow’s two-day drop has now exceeded 3,600 points, a stark reversal from the record highs seen earlier in the year. The Nasdaq sheds more than 900 points as major tech stocks face aggressive sell-offs. Apple, Amazon, and Microsoft all see double-digit percentage losses amid concerns over increased component costs and restricted access to international supply chains.

China, in direct retaliation, announces its own set of counter-tariffs early Friday. The Chinese Ministry of Commerce confirms additional duties on hundreds of U.S. imports, including agricultural products, industrial goods, and electronics. Beijing accuses Washington of triggering a new trade war and warns that the “unilateral protectionism” of the U.S. will ultimately hurt global economic recovery.

Back in Washington, economic analysts warn that the combination of retaliatory tariffs, market panic, and already fragile global supply chains could drag the U.S. economy into a downturn. The Federal Reserve issues a brief statement saying it is “monitoring the situation closely” but does not indicate any immediate intervention.

This is not the first time Trump’s aggressive trade policies have triggered volatility. In 2018, a similar market slide occurred after the president levied tariffs on steel and aluminum imports, sparking trade disputes with Canada, Mexico, and the European Union. That period saw multiple rounds of back-and-forth duties, hurting American farmers, automakers, and manufacturers until temporary agreements were negotiated under the revised USMCA trade deal.

Economists fear that this latest round of global tariffs could be more damaging, as it lacks the targeted focus of previous trade actions and instead affects nearly every country. “This is more than a trade skirmish—it’s a global trade quake,” says Susan Griffith, a senior analyst at Barclays. “Tariffs on this scale risk triggering a global slowdown.”

Despite reassurances from the White House, market sentiment continues to spiral. Wall Street trading floors buzz with uncertainty as hedge funds, investment banks, and retail traders adjust to the new reality of global economic disruption. Volatility indexes spike, and gold prices jump as investors seek safety.

As the trading week comes to a chaotic close, there’s little indication that relief is on the horizon. With no signs of reversal from the White House and Beijing digging in, the U.S. economy faces an unpredictable road ahead. Political fallout may also grow, as lawmakers on both sides of the aisle begin to question the administration’s trade strategy, especially with the 2020 presidential election season approaching.

Sources:

- Fox Business – Stephen Miller Interview

- Associated Press

- CNBC

- Reuters

- Bloomberg